Specialised Accounting Services

Balance sub ledgers to their corresponding G/L accounts

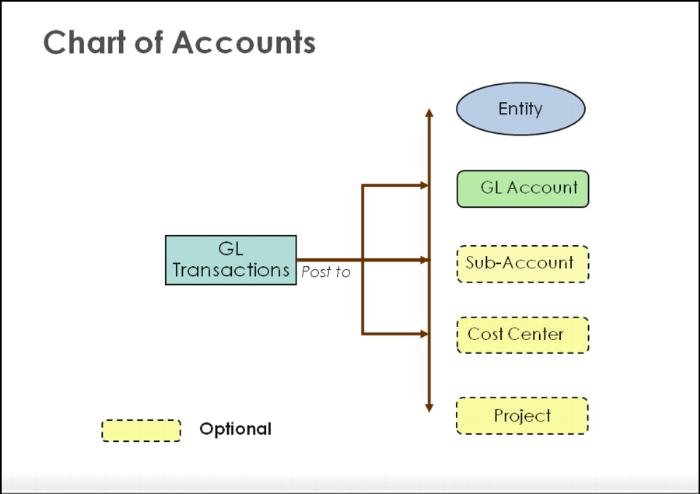

The general ledger is the essential of your company’s financial records. These establish the central ‘books’ of your system and all transaction flows through the general ledger. These records endure as a permanent track of the antiquity of all financial transactions subsequently day one of the life of your firm.

Your accounting system will have a number of subsidiary ledgers (called sub-ledgers) for items such as cash, accounts receivable, and accounts payable. All the entries that are entered (called posted) to these sub-ledgers will manage through the general ledger account. For instance, when a credit sale posted in the account receivable sub-ledger turns into cash due to a payment, the transaction will be posted to the general ledger and the two (cash and accounts receivable) sub-ledgers too.

Numerous businesses provide credit options to their customers for payment. To retain track of your customers' accounts, you record your customer transactions in an accounts receivables subsidiary ledger. You reconcile and record in your main ledger -- the general ledger -- the total of the accounts receivables subsidiary ledger. To reconcile your ledgers, the ending balance of the general journal should agree with the cumulative balances of the subsidiary ledgers.

Accurateness

Before your mail monthly statements to your customers, you must reconcile your accounts receivable ledgers with the total accounts receivable balance from your general ledger to check for mistakes. From your general ledger, add the beginning accounts receivable total to the charge sales for the month. Subtract payments on account for the month and you arrive at your ending accounts receivable total. If this total does not match the sum of the individual customer accounts receivable ledgers, you have a mistake in your statements.

Reconciling the accounts receivable general ledger to a subsidiary ledger includes a four-step process: compute the balance of each accounts receivable account in the subsidiary ledger; total the balances of every subsidiary account; compare this total with the balance in the general ledger; find any differences in the totals; and correct the mistake.

You can start at the customer's subsidiary ledger where an entry might seem disordered or corrected. Then check your cash receipts journal and your sales journal. It might be that you had forgotten to record the transactions. A customer may tell you that he found an error on his invoice. If he complains, change his balance and make a notation on his file in the sub ledger to avoid a quarrel. This gives you time to find the error, if any. Depending on the inconsistency you find, discuss the matter with the customer.

Disclaimer: The software content used in this page is only for customers to know about the software and not for any commercial intentions.

The main benefits of working with accountingoutsource2india are below:

Consistent Data Source – accountingoutsource2india business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: accountingoutsource2india work give significant cost reduction and gives you high Return of asset.

High Superiority Work - Main benefits of accountingoutsource2india work is to get high quality work as per your needs.

Well-organized Data Management: accountingoutsource2india provider companies take input data from any source and give output data into digital format or as you need set-up so this provide better organization of data.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of accountingoutsource2india.

We work 24/7 days for more details feel free to contact us at any time you required.