Reconciliation Accounting

Clean up unapplied payments and open credit invoices

Accounts receivable similarly known as Debtors, is money owed to a business through its customers and shown on its balance sheet as an asset. It is one of a sequence of accounting transactions dealing with the billing of a client for goods and services that the client has ordered.

Accounts receivable signifies money owed by objects to the company on the sale of products or services on credit. In maximum business objects, accounts receivable is naturally performed through creating an invoice and either mailing or electronically delivering it to the client, who, in turn, should pay it within a recognized timeframe, called credit terms or payment terms.

Fix Unapplied Customer Payments and Credits with CDR

Within the Client Data Review feature is the Fix Unapplied Customer Payments and Credits tool. On the first tab, the Open Invoices are matched with the Customer Payments that have remained received, but not practical to an invoice. Towards apply these transactions, select a name from the Customers tab, then on the Invoices & Charges tab, and select a payment to apply to an invoice by placing a check in the check box. You can choose Auto Apply All to apply all of the payments or each Payment and Invoice can be designated individually, then select Apply.

Once applied, the transactions will be grayed on this window until Save is selected. The transactions will not appear once more the next time the tool is opened.

Fix Unapplied Customer Payments and Credits

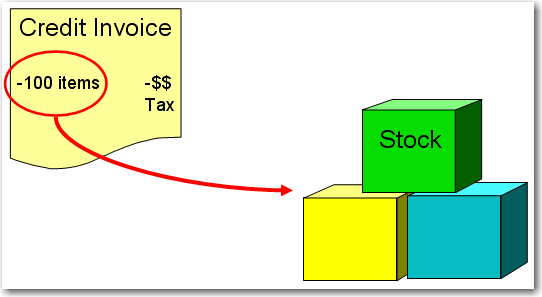

Frequently, your customers will generate a credit memo or receive a payment from a client but not apply it to the original open invoice. The net total on the Aging Summary report is accurate, however when looking at the Open Invoices report, both the credit memo and unapplied payment and open invoice amount are still listed.

Use the new CDR clean-up feature to apply the open credit or unapplied payment to the open invoice. The window will only show those clienteles with open credits or payments that required to be applied. You can apply them one at a time or select a customer on the left and auto apply to all transactions.

Before CDR, we would have to select Customers > Receive Payments, stipulate the customer or job, and then highlight the invoice(s) imperfectly showing as unpaid, and then hit Set Credits to apply previously unapplied payments and credits. And we would have to do this over and over again, until all the jobs were “fixed.” Not brain surgery, but with numerous such jobs, it would be tiresome and time-consuming.

This is not tiresome any longer with CDR’s “Fix Unapplied Customer Payments and Credits.”

In the Client Data Review, go to the section Accounts Receivable and click on Fix Unapplied Customer Payments and Credits.

Disclaimer: The software content used in this page is only for customers to know about the software and not for any commercial intentions.

The main benefits of working with accountingoutsource2india are below:

Consistent Data Source – accountingoutsource2india business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: accountingoutsource2india work give significant cost reduction and gives you high Return of asset.

High Superiority Work - Main benefits of accountingoutsource2india work is to get high quality work as per your needs.

Well-organized Data Management: accountingoutsource2india provider companies take input data from any source and give output data into digital format or as you need set-up so this provide better organization of data.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of accountingoutsource2india.

We work 24/7 days for more details feel free to contact us at any time you required.