Managed Accounting Services

Process Cost Accounting

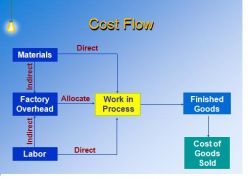

Process costing is a word used in cost accounting to define one method for collecting and assigning manufacturing costs to the units produced. Processing cost is used when nearly identical units are mass produced.

Technique for determining the total unit cost of the output of a continuous production run (such as in food processing, petroleum, and textile industries) in which a product passes through several processes (or cost centers).

It contains the following steps:

(1) The 'total cost per process' is computed through estimating the number of products passing through each process in a given period;

(2) The 'unit cost per process' is computed through dividing the 'total cost per process' by the number of units passing through the process in the given period;

(3) The 'unit cost per process' is charged to each unit as it passes through each process so that, at the end of the production cycle, each product will have received an appropriate charge for each process through which it has passed.

In management accounting, cost accounting creates budget and actual cost of operations, processes, departments or product and the analysis of variances, profitability or social use of funds. Managers use cost accounting to support decision-making to cut a company's costs and improve profitability. As a form of management accounting, cost accounting need not to follow standards such as GAAP, because its primary use is for internal managers, rather than outside users, and what to compute is instead decided practically.

Costs are measured in units of nominal currency by convention. Cost accounting can be viewed as translating the supply chain (the series of events in the production process that, in concert, result in a product) into financial values.

There are numerous managerial accounting approaches:

- Standardized or standard cost accounting

- Lean accounting

- Activity-based costing

- Resource consumption accounting

- Throughput accounting

- Marginal costing/cost-volume-profit analysis

Cost accounting has long been used to benefit managers understand the costs of running a business. Modern cost accounting originated during the industrial revolution, when the complexities of running a large scale business led to the development of systems for recording and tracking costs to help business owners and managers make decisions.

In the early industrial age, most of the costs acquired by a business were what modern accountants call "variable costs" because they varied directly with the amount of production. Money was spent on labor, raw materials, power to run a factory, etc. in direct proportion to production. Managers might simply total the variable costs for a product and use this as a rough guide for decision-making processes.

Some costs tend to remain the same even during busy periods, unlike variable costs, which rise and fall with volume of work. Over time, the importance of these "fixed costs" has become more important to managers. Instances of fixed costs include the depreciation of plant and equipment, and the cost of departments such as maintenance, tooling, production control, purchasing, quality control, storage and handling, plant supervision and engineering. In the early twentieth century, these costs were of little importance to most businesses. Though, in the twenty-first century, these costs are often more significant than the variable cost of a product, and allocating them to a broad range of products can lead to bad decision making. Managers must understand fixed costs in order to make decisions about products and pricing.

Disclaimer: The software content used in this page is only for customers to know about the software and not for any commercial intentions.

The main benefits of working with accountingoutsource2india are below:

Consistent Data Source – accountingoutsource2india business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: accountingoutsource2india work give significant cost reduction and gives you high Return of asset.

High Superiority Work - Main benefits of accountingoutsource2india work is to get high quality work as per your needs.

Well-organized Data Management: accountingoutsource2india provider companies take input data from any source and give output data into digital format or as you need set-up so this provide better organization of data.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of accountingoutsource2india.

We work 24/7 days for more details feel free to contact us at any time you required.