Reconciliation Accounting

Reconcile bank statements to G/L accounts

A company's general ledger account Cash comprises a record of the transactions that include its checking account. The bank also generates a record of the company's checking account when it procedures the company's checks, deposits, service charges, and other items. Quickly after each month ends the bank typically mails a bank statement to the company. The bank statement lists the activity in the bank account during the recent month as well as the balance in the bank account.

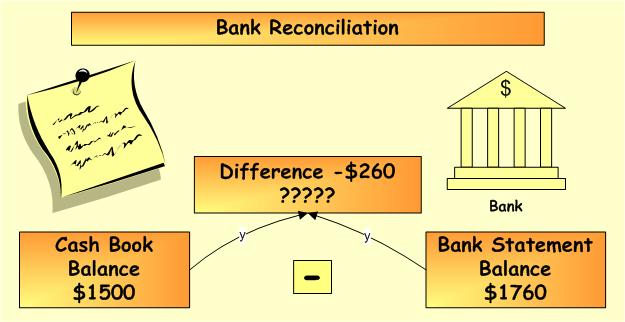

When the company receives its bank statement, the company must confirm that the amounts on the bank statement are reliable or compatible with the amounts in the company's Cash account in its general ledger and vice versa. This procedure of checking the amounts is referred to as reconciling the bank statement, bank statement reconciliation, bank reconciliation, or doing a "bank rec." The advantage of reconciling the bank statement knows that the amount of Cash reported by the company is reliable with the amount of cash shown in the bank's records.

Since most companies write hundreds of checks each month and make many deposits, reconciling the amounts on the company's books with the amounts on the bank statement can be time consuming. The procedure is difficult since some items appear in the company's Cash account in one month, but perform on the bank statement in a different month. For instance, checks written near the end of August are deducted directly on the company's books, but those checks will likely clear the bank account in early September. Sometimes the bank decreases the company's bank account without informing the company of the amount. For instance, a bank service charge may be deducted on the bank statement on August 31, but the company will not learn of the amount until the company receives the bank statement in early September. From these two instances, you can understand why there will likely be a difference in the balance on the bank statement vs. the balance in the Cash account on the company's books. It is also possible that neither balance is the true balance. Both balances might need adjustment in order to report the true amount of cash.

Subsequently you adjust the balance per bank to be the true balance and after you adjust the balance per books to also be the similar true balance, you have reconciled the bank statement. Most accountants would simply say that you have done the bank reconciliation or the bank rec.

The bank statement already shows the bank service charge. Still, the company typically doesn’t know the amount of the service charge until the bank statement attains. So at that point the service charge is not in the company’s general ledger. To reconcile the bank statement with the general ledger Cash account, you will require entering the bank service charge into the Cash account. Therefore, in the bank reconciliation procedure the bank service charge will be listed as an adjustment to the books (to the Cash account).

Disclaimer: The software content used in this page is only for customers to know about the software and not for any commercial intentions.

The main benefits of working with accountingoutsource2india are below:

Consistent Data Source – accountingoutsource2india business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: accountingoutsource2india work give significant cost reduction and gives you high Return of asset.

High Superiority Work - Main benefits of accountingoutsource2india work is to get high quality work as per your needs.

Well-organized Data Management: accountingoutsource2india provider companies take input data from any source and give output data into digital format or as you need set-up so this provide better organization of data.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of accountingoutsource2india.

We work 24/7 days for more details feel free to contact us at any time you required.