Managed Accounting Services

Two Types of Cost Accounting Systems

Cost accounting, according to Dr. Larry Walther, Ph.D., a Utah State University accounting professor and textbook author, is the "collection, assignment, and interpretation of cost". Simply put, it is the capture and analysis of cost data. In a manufacturing environment, numerous types of cost contribute to producing the product. Accounting for these costs in financial and managerial reports improves understanding of the manufacturing operation's profitability and empowers decision making. For costs, the primary two cost accounting methodologies are job costing and process costing.

Job Costing

In job costing, definite costs are tracked and allocated to an exact product or batch. Job costing is used most often when one-of-a-kind or distinct batches of product are produced. Raw materials are easily noticeable to a finished product. Different products will have different costs. The total cost of a job is determined by summing the materials, labor and overhead costs then dividing by the total units manufactured.

Process Costing

When the manufacturing process is continuous and produces largely homogenous products, like breakfast cereal or sheet metal, process costing might be utilized. Manufacturing costs are combined and divided among total output. This method is useful when it is difficult to attach specific costs to each unit produced. In product costing, the average cost of materials per unit is determined for a particular reporting period.

Management accounting is an internal business function that offers accounting information to department managers, which allows them to be informed, make better business decisions and plan department policies to increase revenue while decreasing costs. The accounting department prepares reports for department heads, confirming detailed cost information is included. Some costs a department manager has control over, while fixed overhead costs leave little room for improvement.

Direct Costs

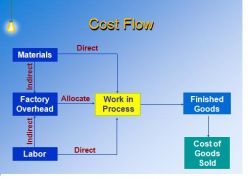

Direct costs represent any cost related to the production of goods or services. Raw materials, labor and manufacturing overhead are primary direct costs. Raw material costs contain the physical materials a company uses to produce consumer goods. Labor represents employees directly involved in the company's manufacturing process. These individuals run the equipment or convert raw materials into finished goods. Manufacturing overhead is the cost of facilities or equipment companies use to produce goods and services.

Indirect Costs

Indirect costs contain expenses outside of a company's production process. Office supplies, sales personnel, accounting and customer service operations represent a few common indirect costs. The amount of indirect costs must represent a much smaller proportion of the company's overall business expenditures. High indirect costs indicate companies spend more money on potentially non-essential business functions.

Disclaimer: The software content used in this page is only for customers to know about the software and not for any commercial intentions.

The main benefits of working with accountingoutsource2india are below:

Consistent Data Source – accountingoutsource2india business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: accountingoutsource2india work give significant cost reduction and gives you high Return of asset.

High Superiority Work - Main benefits of accountingoutsource2india work is to get high quality work as per your needs.

Well-organized Data Management: accountingoutsource2india provider companies take input data from any source and give output data into digital format or as you need set-up so this provide better organization of data.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of accountingoutsource2india.

We work 24/7 days for more details feel free to contact us at any time you required.