Reconciliation Accounting

Checking bank statements to G/L

This process will benefit you reconcile Accounts Payable to the General Ledger in Turning Point.

Reconciled balance

In order towards reconcile, you should begin with the last known reconciled balance of the Accounts Payable account. If you have not been reliably reconciling your Accounts Payable to the General Ledger, you will require following the Steps to Determine a Beginning Balance below. Once this is finished, then you can begin auditing on a consistent basis.

Steps to Regulate a Reconciled Beginning Balance

If you do not have a reconciled balance, you should enter an adjustment to the General Ledger to force the balance in General Ledger to equivalent the balance of your total payable in Accounts Payable. To regulate the modification amount do the following:

1. Post all transactions in Accounts Payable. To confirm that all is posted, select ALL activity dates within the post screen (A/P, Processes, Post to GL) and click on verify. All entries that are printed on the report created should be posted to the General Ledger before continuing to step 2. Note: They must be posted since all of these entries have pretentious you’re A/P reports but have not yet affected your general ledger.

2. Post all transactions in General Ledger for all periods (G/L, Transactions and Post). Note: in the post screen be sure to take the check mark out of ‘locked periods” and “out of balance” so you can see all unposted entries.

3. Print an Invoice Aging report for the current day in Accounts Payable.

4. Print a list of all invoices in a/p that have a status of ‘held’ (Accounts Payable, Transactions, Transaction Entry, List Button – select invoice status of “Not Posted”). Deduct the total from this report from your Invoice Aging report – this amount will be referred to as the ‘modified Invoice Aging amount.

5. In the General Ledger print a Trial Balance for the last period of the current year and for the current period of the current year.

6. If the two Trial Balance reports match, then you can endure to step 6. If they do not match, then you have transactions posted to a future period. In that case, you must use your Trial Balance for period 13 in step

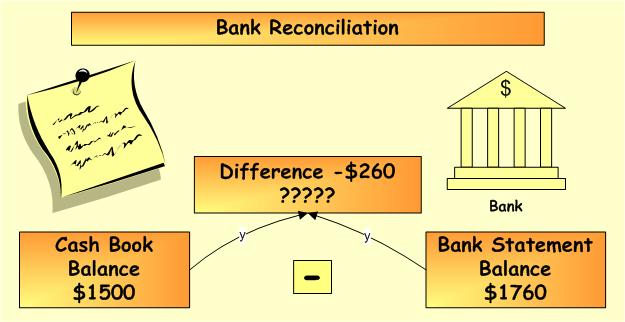

7. Associate the balance from you is modified A/P Invoice Aging report to the Trial Balance.

8. If they do not match, do a manual adjusting entry in General Ledger to bring the two values in line. This will offer you with a valid starting point and you can begin to reconcile from this point forward. If they do match, no entries are required and your reconciliation is comprehensive.

Reconcile Process with All Entries Posted

1. Post all transactions in the Accounts Payable. To confirm that everything is posted, select ALL activity dates within the posting screen and click on verify. All entries that are printed on the report created must be posted to the General Ledger before proceeding to step 2.

2. Print the Invoice Aging report in A/P for the last day of the month you want to reconcile.

3. Print a list of all unposted invoices in A/P from the Transaction Entry list button. Deduct this amount from your Invoice Aging report – this becomes your altered Invoice Aging amount.

4. Post all transactions in the General Ledger for the period you are reconciling.

5. In the General Ledger print the Trial Balance for the period you are reconciling.

6. Compare the balance on your altered Invoice Aging report to your Accounts Payable balance on the Trial Balance

7. If the balances match, congratulations your books are in balance! If they do not match:

A. From the General Ledger, print the Journal report. Select the accounts payable general ledger account number you are reconciling for the period you are closing. This displays all of the transactions and what module they posted from. Any transaction that has a source other than CD or AP is a transaction that affected the General Ledger and did not affect the Accounts Payable module. The entries must be reversed and entered through Accounts Payable. For instance; if the source code is GJ – manual transactions were entered in the General Ledger. The transactions exaggerated the General Ledger, but not the Accounts Payable module or reports.

B. Appraisal the posting logs received in Accounts Payable (after posting to the general ledger) subsequently this account was reconciled. Each invoice on the A/P log should credit an a/p account and each credit memo should debit an a/p account – if you are seeing whatever other than that then those entries should be modified.

C. Associate the posting logs established when you posted Accounts Payable to the General Ledger to the Journal report. The transactions that show on the Posting report must also be seen on the Journal report. Confirm that all transactions were posted to the correct period and year. Also, evaluation you’re posting reports to confirm that all transactions were entered with a suitable Accounts Payable account

D. Check the Accounts Payable module to see if there are unposted transactions in previous periods by clicking the Verify button in Post to General Ledger. Remain sure to select ALL dates so you can review all unposted transactions. The unposted transactions affect your Accounts Payable module, but would not affect your General Ledger module.

E. Print the Trial Balance for the last period of the current year to confirm if any A/P transactions were posted to a future period.

Disclaimer: The software content used in this page is only for customers to know about the software and not for any commercial intentions.

The main benefits of working with accountingoutsource2india are below:

Consistent Data Source – accountingoutsource2india business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: accountingoutsource2india work give significant cost reduction and gives you high Return of asset.

High Superiority Work - Main benefits of accountingoutsource2india work is to get high quality work as per your needs.

Well-organized Data Management: accountingoutsource2india provider companies take input data from any source and give output data into digital format or as you need set-up so this provide better organization of data.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of accountingoutsource2india.

We work 24/7 days for more details feel free to contact us at any time you required.