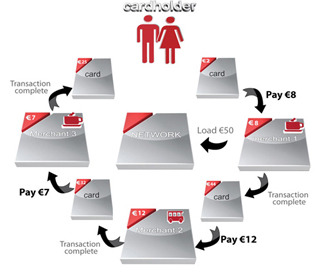

A withdrawal through a client, using an ATM, establishes a real time withdrawal by such client out of their own account. ATMs might either belong or be contracted to the bank holding the account of the client or another bank. A client recruits the transaction by inserting their ATM qualified card in the ATM, after which the ATM will request that the Personal Identification Number (PIN) be keyed to confirm that the transaction is in fact being introduced through the customer. This requirement defends the customer from the system being misused to acquire funds falsely from the customer’s account. As the customer is responsible for safekeeping of both the ATM Card and the PIN any transaction originated, using both the card and PIN, will be considered to have been initiated through the client.

A transaction originated at an ATM is proximately passed on to the bank where the customer’s account is held together with the PIN encrypted format. The paying bank (customer’s bank) has the capability through its security system to confirm the correctness of the PIN without the PIN ever being exposed to anybody during the procedure. All transactions are exclusively referenced to enable easy identification of the transaction where successive enquiry or audit is required.

Having confirmed the PIN and confirmed that the customer has sufficient funds in the account to cover the requested withdrawal, the customer's bank (authorizing bank) will debit the account of the customer, then send a message, via SASWITCH (if across banks), through the bank controlling the ATM, authorizing the amount requested be paid out. The ATM would then continue with dispensing of the authorised amount if it contains adequate bank notes to make the payment.

Usually, if any one of the required messages or actions fails to be performed, the ATM and or the system/s of the bank/s and PSO will record such mistake with a code indicating the type of failure, send an error message to the other parties to designate that the action has failed and the system/s will reverse any entries that could not be finished.

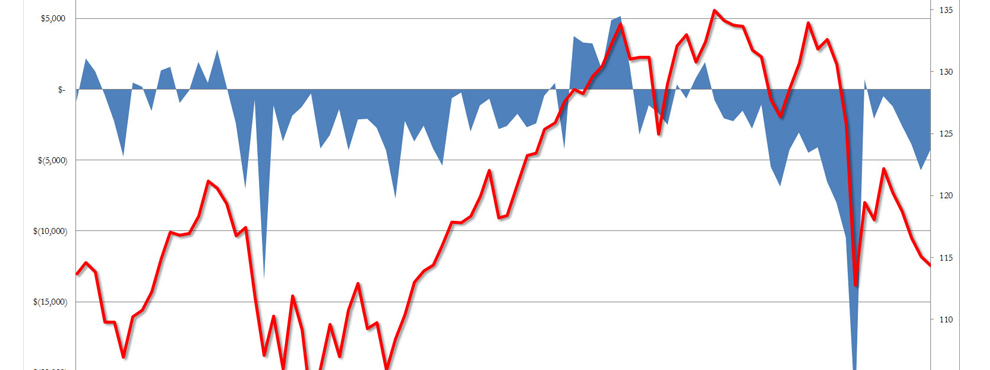

All banks involved in the exchange of ATM transactions are obligatory to reconcile the records of transactions on a daily basis so as to confirm that the system is kept in balance and any incomplete transactions can be corrected quickly. A bank receiving a query regarding irregular transactions has four working days to resolve an inquiry.

The main benefits of working with Reconciliationaccounting are below:

Consistent Data Source – Reconciliationaccounting business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: Reconciliationaccounting work give significant cost reduction and gives you high Return of asset.

High Superiority Work – Main benefits of Reconciliationaccounting work is to get high quality work as per your needs with reasonable rates.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of Reconciliationaccounting.

We work 24/7 days for more details feel free to contact us at any time you required.