Services

How to Keep Track of Petty Cash

How to Keep Track of Petty Cash

Following petty cash is a significant feature of small-business financial management. Failure to do so might leave you with an incorrect or incomplete picture of your company's financial situation. It can also lead to defective accounting, frivolous or wasteful spending, or loss or theft through unscrupulous employees. Prevent these issues through keeping constricted controls over how your small business uses petty cash, as well as who has access to it.

Write a petty cash policy for your small business. Your policy must clearly outline what is and isn't an acceptable use of the cash fund; such uses preferably are limited to business expenses. Stamps for occasional mailings or cleaning supplies for the restroom are characteristic small-business expenses covered by petty cash. The money must not be used for employee personal expenses. Your policy might comprise a limit on petty cash withdrawal amounts, the requirement for receipts for items purchased out of petty cash, and a list of employees who are authorized to approve and distribute withdrawals. Confirm all employees are acquainted with the petty cash policy.

Establish a set amount of money to be continued for petty cash use, based on the types and amounts of small cash expenses you naturally make.

Buy a locking cash box for your petty cash and store it in a safe location at your small business. Limit the number of employees having access to the box. This makes it stress-free to safeguard all transactions are recorded and reduces the opportunity for employee theft.

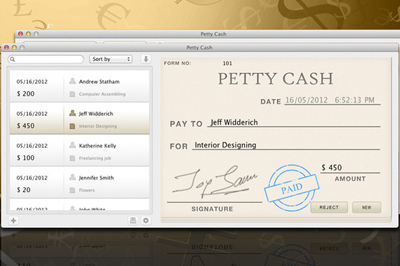

Set up a sign-out sheet or numbered voucher system and store these with the cash box. Document all expenditures from petty cash on the sign-out sheet, which should list the employee's name, the date, the amount of cash withdrawn and the purpose of the withdrawal. As an alternative, fill out a voucher with the same information and give it to the petty cash recipient. When the purchase is completed, the employee returns the voucher, attached to the dated receipt exactness the purchase.

Please find our company's pricing structure is as below:

- Hourly Rate: For projects with time priority, smaller or having exclusive requirements.

- Monthly Rate: For VIP clients who have established or want to establish long-term relationship.

- Project Rate: For middle to large volume data projects, estimating the length of the process and offering discount on hourly rate.

- Transaction Rate: For particular services in case of high volume transaction entry.

Quickbooks4accounting.com main aim is customer's satisfaction and business up gradation.

Quickbooks4accounting.com provides full time availability, quality work, low pricing to any online firm and you will get their assistance 24/7 round the clock,

The main benefits of working with quickbooks4accounting are below:

Consistent Data Source - quickbooks4accounting business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: quickbooks4accounting work give significant cost reduction and gives you high Return of asset.

High Superiority Work - Main benefits of quickbooks4accounting work is to get high quality work as per your needs.

Well-organized Data Management: quickbooks4accounting provider companies take input data from any source and give output data into digital format or as you need set-up so this provide better organization of data.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of quickbooks4accounting.

We work 24/7 days for more details feel free to contact us at any time you required.

The imageries and Content uploaded in this site is only for explanation and not for any other purposes